Silver Falls, Markets Embrace Safe Haven Mode

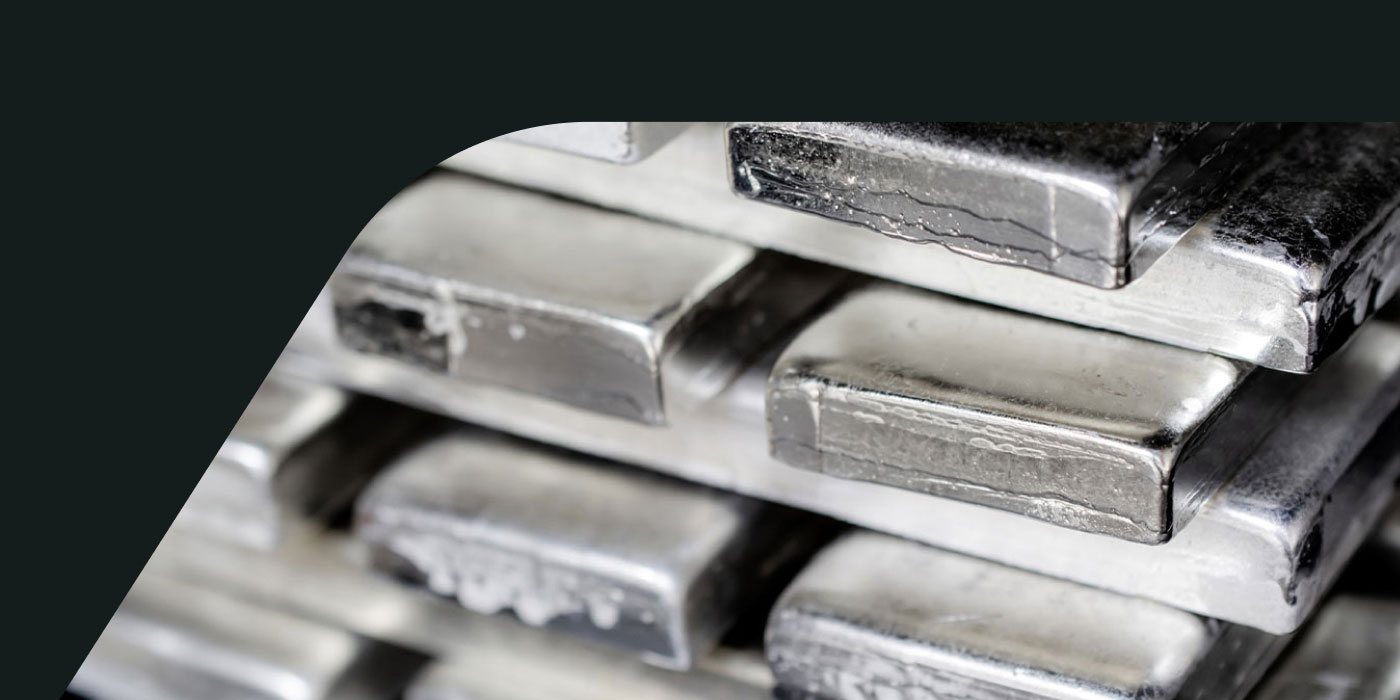

Silver experienced a sharp correction in trading on Friday (January 15th), after Chinese authorities took steps to "cool" the mainland futures market—a market that had recently been a driving force behind the global silver rally, which had reached record levels. Spot silver plunged as much as 5.1%, continuing the decline seen in the previous session, while gold held steady.

The main trigger came from tightening regulations on Chinese futures exchanges. Regulators asked exchanges—including the Shanghai Futures Exchange (SHFE)—to regulate high-frequency trading activities, including infrastructure (server) adjustments and reducing the maximum intraday position limit for silver futures contracts. After "unusual" volatility in recent days, this move was seen as a signal that China wanted to curb excessive speculation.

Despite the correction, silver's performance this week was still quite strong: it still rose around 12% weekly, although the pace of gains began to slow after the US on Wednesday chose to refrain from imposing immediate import tariffs on critical minerals. The lingering threat of tariffs fueled the rally, but the decision not to impose broad import duties prompted some market participants to take profits.

On the other hand, silver's major rally hasn't completely broken. Its rapid rise over the past year has been supported by investors' rotation into commodities—along with concerns about currency weakness, ballooning government debt, and unpredictable policy risks. However, already excessively high prices also have the potential to trigger increased recycling, although the supply of scrap materials is still considered constrained by limited high-grade refining capacity.

Towards the end of the London session, silver fell 2.9% to $89.7018 per ounce. Gold edged up 0.1% to $4,618.92 per ounce and is still on track to gain around 2% for the week. Platinum and palladium also weakened, each down at least 3%, while the dollar index remained relatively flat.

Source: Newsmaker.id