Oman Becomes the Stage: Conflict Ease or Deception?

Yesterday's US-Iran meeting in Oman didn't produce any major agreements, but one thing is clear: the path to negotiations has reopened. Both sides agreed to continue talks, and this immediately changed the previously tense market mood.

From the Iranian side, the tone was indeed calmer, but its red lines remained firm. Tehran called the talks a "step forward," but they continued to reject demands leading to a complete halt to uranium enrichment (zero enrichment).

Iran also stated that the discussions focused on the nuclear issue, not diverging into other topics. They also emphasized that their missile program was not on the negotiating table—in other words, it was not a bargaining chip.

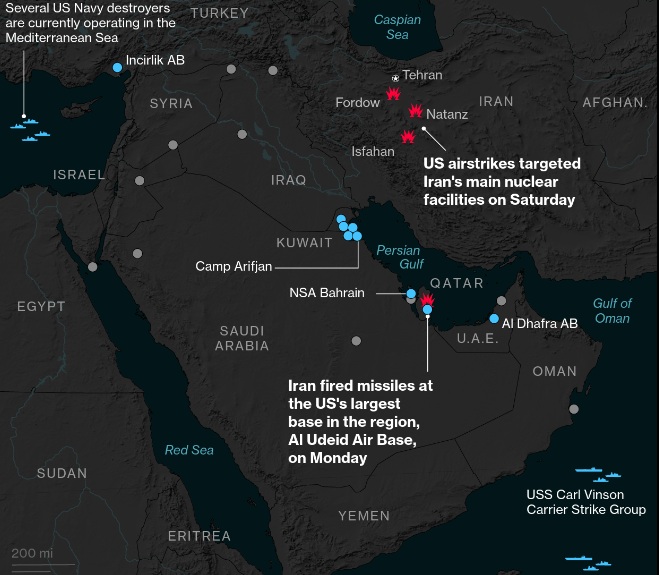

Meanwhile, from the US side, Trump signaled a follow-up meeting early this week, amidst the US military buildup in the region and an upcoming meeting with Israeli Prime Minister Benjamin Netanyahu. At the same time, the US is also preparing economic pressure, including planned tariffs on countries that continue to do business with Iran.

The bottom line: this is just the "opener," not the finish line. After a long stalemate, both sides now at least acknowledge there's still room for discussion, despite the significant distance between their positions, particularly on uranium enrichment rights and sanctions.

Beyond that, the market is also monitoring the domino effect on global energy—for example, the still-unclear issues surrounding India and Russian oil, plus new reports this week from OPEC/IEA/US forecasters that could alter supply perceptions.

Market Impact: Because the talks were deemed "quite positive" and the risk of near-term conflict diminished, oil weakened, with Brent falling to the $67 area and WTI to the $63 area as risk premiums began to be released. While gold typically loses some of its safe-haven appeal when tensions ease, it remains sensitive—previously, gold was supported by concerns ahead of the US-Iran talks and a weakening dollar, so its direction could still fluctuate depending on further headlines and US data.

5 key points:

- No major deal yet, but negotiations continue.

- Iran: Uranium enrichment rights are "non-negotiable," zero enrichment rejected.

- Iran: Nuclear discussions only, missiles off the table.

- US: Trump says there will be further meetings, political and economic pressure remains.

- Market response: Oil falls as supply risks ease; gold remains choppy due to lingering uncertainties. (asd)

Source: Newsmaker.id