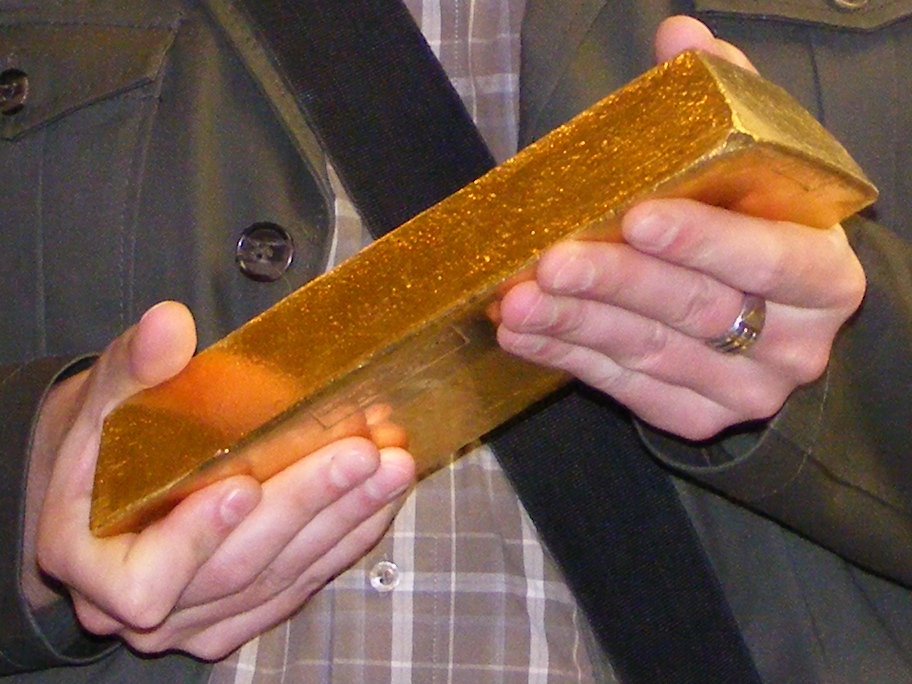

Gold prices remain near record highs, lacks upside conviction amid mixed signals

Gold prices attracted some safe-haven flows amid risk-off sentiment and Middle East tensions. A modest USD weakness further benefitted XAU/USD, though the upside seemed limited.

The fight for a smaller rate cut by the Fed should limit the USD losses and cap the yellow metal.

Gold (XAU/USD) prices rose for the second straight day on Wednesday also marking the fourth day of a positive move in the previous five and touched a one-and-a-half-week high, around the $2,670 region during the Asian session.

A decline in the US Treasury bond yields dragged the US Dollar (USD) away from over two-month tops touched earlier this week and turned out to be a key factor underpinning the commodity. Further, a turnaround in the global risk sentiment as depicted by a softer tone across the global equity markets drove some safe-haven flows towards the precious metal amid persistent geopolitical risks.

Additionally, buoyant demand from central banks offered additional support to Gold prices. That said, firming expectations for less aggressive policy easing by the Federal Reserve (Fed) and bets for a regular 25 basis points (bps) interest rate cut in November should limit any meaningful USD corrective slide.

This, in turn, might hold investors from placing fresh bets around the non-yielding yellow metal. Additionally, reports that Israel will refrain from targeting Iran’s oil and nuclear sites might contribute to capping gains for the XAU/USD, warranting some caution before positioning for any further near-term appreciating move.

Source: FXStreet