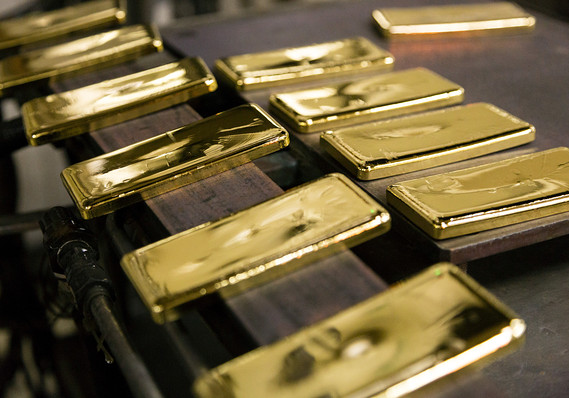

Gold Rises as Market Looks Ahead to US Payrolls Data

Gold rose slightly, as the market looks to US labor data this week for clues on how aggressive the Federal Reserve's imminent rate-cutting cycle will be.

Bullion has traded in a narrow range around $2,500 in recent days. It edged higher Wednesday following a report that showed US job openings fell in July to the lowest since the start of 2021. The figures added to signs of a cooling labor market, bolstering bets for steep rate cuts, which would likely aid gold, as it doesn't pay interest.

The US nonfarm payrolls report is due Friday. The previous print ââ-š¬Ã¢â‚¬ one of the weakest since the pandemic ââ-š¬Ã¢â‚¬ proved crucial after the numbers contributed to August's global stock rout, dragging down gold as traders covered margin calls.

Bullion has surged more than 20% this year, supported by growing optimism the Fed will pivot to monetary easing. Robust over-the-counter purchases and strong haven demand due to conflicts in the Middle East and Ukraine have also helped the advance.

Spot gold was up 0.4% to $2,506.38 at 8:30 a.m. in London, after peaking at a record $2,531.75 in August. The Bloomberg Dollar Spot Index was steady, following a 0.3% decline in the previous session. Silver and platinum rose, while palladium was little changed.

Source : Bloomberg